Towards the end of August, Yobit launched a new program named Virtual Mining. At Virtual Mining, users can choose between six virtual miners and buy one of them. Upon purchasing one miner, users receive their income in the MINEX token which is the mining token here.

Unlike typical cloud mining websites, Yobit clearly defined how they handle the investments – and this stinks after a Ponzi scheme. Here’s why:

The scheme behind Virtual Mining

According to Yobit, 90 to 85% of the invested funds will be used to buy back MINEX token. This means, with every purchase of a miner (except Micro miner), a large part of the funds goes to keep up (or increase) the price of Minex token.

In addition, the remaining funds will be used to buy back YO token which is another token created by Yobit.

Finally, every miner purchase (except Micro) results in a price increase of 0.1% for all miners and the MINEX/BTC buy price for Yobit’s buy back increases by 0.1%.

“But what does that mean? I mean, the price will always go up??”. Nope, and here’s why:

The scheme always need fresh investors’ money

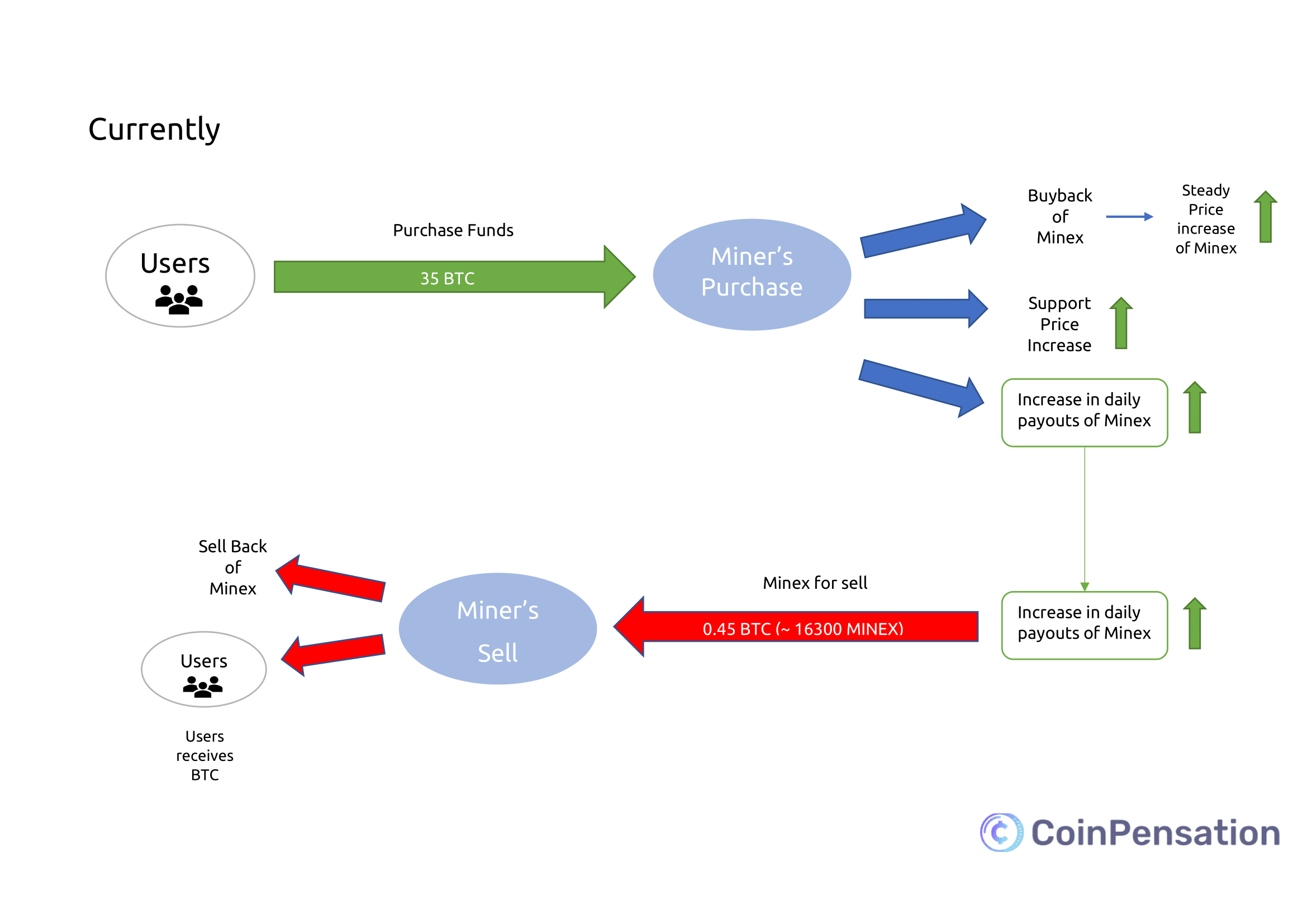

A month ago and currently, the cash flow (income is greater than expenditures) in the scheme is positive which results, of course, at a steady price increase. The following depiction shows what happens currently.

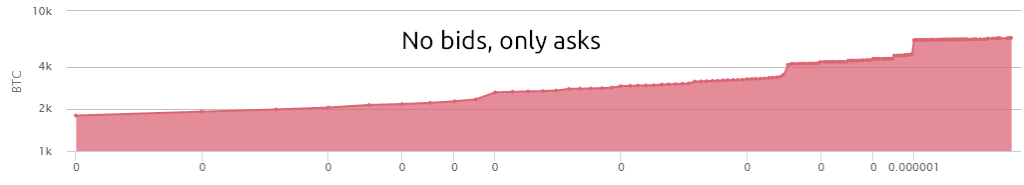

Currently, more users invest more funds into Virtual Mining than what they get from Virtual Mining. Therefore, the buy order side (the bidders) is constantly growing with increased price support coming from every purchase.

But what will happen in times of increasing miner prices and increasing daily payouts of Minex token?

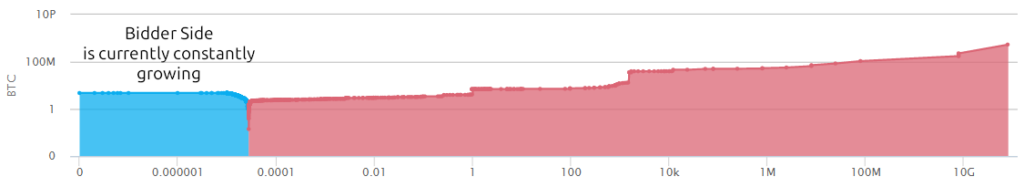

Virtual Mining is Doomed To Fail

Absolutely! Increasing miner prices will lead to exclusion of smaller market participants. This means many people won’t afford to buy a Micro Miner since the price might be at around $300 or even $700 – too expensive for many people. This causes missing buy support. Meanwhile, the number of circulating Minex token amongst users will increase which leads to greater sell orders. Effectively, the expenditures are greater than the incomes. The consequence: Minex price will go straight away down to the bottom. The visual depiction shows what happens in a couple of months.

This depiction shows that selling Minex token is only possible as long as there are buyers (a positive cashflow). In this case, Yobit is the only buyer as they support the Minex token with every miner purchase. Since the purchase funds decrease over time as a consequence of a high miner price, there won’t be any bidders.

Final Thoughts

Yobit Virtual Mining shows signs of a Ponzi scheme which is, in general, doomed to fail. The miner prices have spiked in less than a month from 0.01 BTC to 0.018 BTC which makes it difficult to buy a miner. If this goes on, we will probably see in a few months exorbitant prices that not everybody can afford to buy. This causes a strong price dump to one Satoshi and a loss for those who aren’t in profit. In general, Yobit does not promise a profit in USD. Therefore, invest only what you can afford to lose.

If you enjoyed reading this article, you can also take a look at some bulletpoints to uncover a scam cloud mining website.

Update of 28th November: The Doom already set in

As we predicted two months ago, the MINEX price already found its way to one Satoshi. This means, the scheme is about to collapse and, everyone, who invested there, is about to earn pennies instead of dollars.

Moreover, Yobit also set specific criteria in order to continue earning from the miners. It is required to hold 10% from the current miners’ cost in YoTokens which is named YoPower. This strategy allows Yobit to prevent higher MINEX payouts which would place pressure on the MINEX price, decreasing the price much further down.

In the meantime, Yobit replaced the old plans with newer plans that pays out significantly more MINEX token. Do you remember, when the Micro (the lowest plan) paid 9 MINEX daily? It got replaced by Micro V3 whose daily payment amounts to 180 MINEX. An increase of 2,000% in just two months!

Why did Yobit Virtual Mining failed earlier than expected?

However, I do believe this strategy won’t rescue existing and new investors from making a loss.

There is one possible reason: In the beginnings of the launch of VMining, Yobit promoted it heavily. For instance, they send multiple newsletters to remind users of not missing the train, launched contests and, of course, connected the affiliate the program with VMining.

Naturally, this approach of trying to get as many users as possible shortly after launching such scheme (or generally HYIP, cloud mining etc…) results in a loss both for early & later investors. A more sustainable way might be a slow increase in userbase & investments which Yobit did not follow hereby.

GET out of YOBIT! They will NOT HELP if you need it! I`m on 5 other platforms, got help from them after my papers got burned! NOT YOBIT, they MAKE it easy. They tell you, that they will NOT HELP you! I has tgot the mail, again and again! This is NOT protected by the LAW. I call them Criminals! By NOT giving me and many other access to our COINS! Yobit is STEALING ous COINS! One GUY has 2 bitcoins, and they deny him HELP! Those are CRIMINALS!!